Three ways Virgin Money Australia is making banking better

Since its new digital bank launched in April 2021, Virgin Money Australia is quickly changing the face of banking and setting a new standard for a simpler system which focuses on customer satisfaction above all else.

Here are three ways Virgin Money Australia is shaking up the financial services industry for good.

Prioritising simplicity

Have you ever been in a high street bank and wondered why everything to do with your finances has to be so complicated? If dealing with numbers makes you break out in a cold sweat then don’t despair, Virgin Money Australia’s new digital bank will keep you calm, collected and in control of your finances.

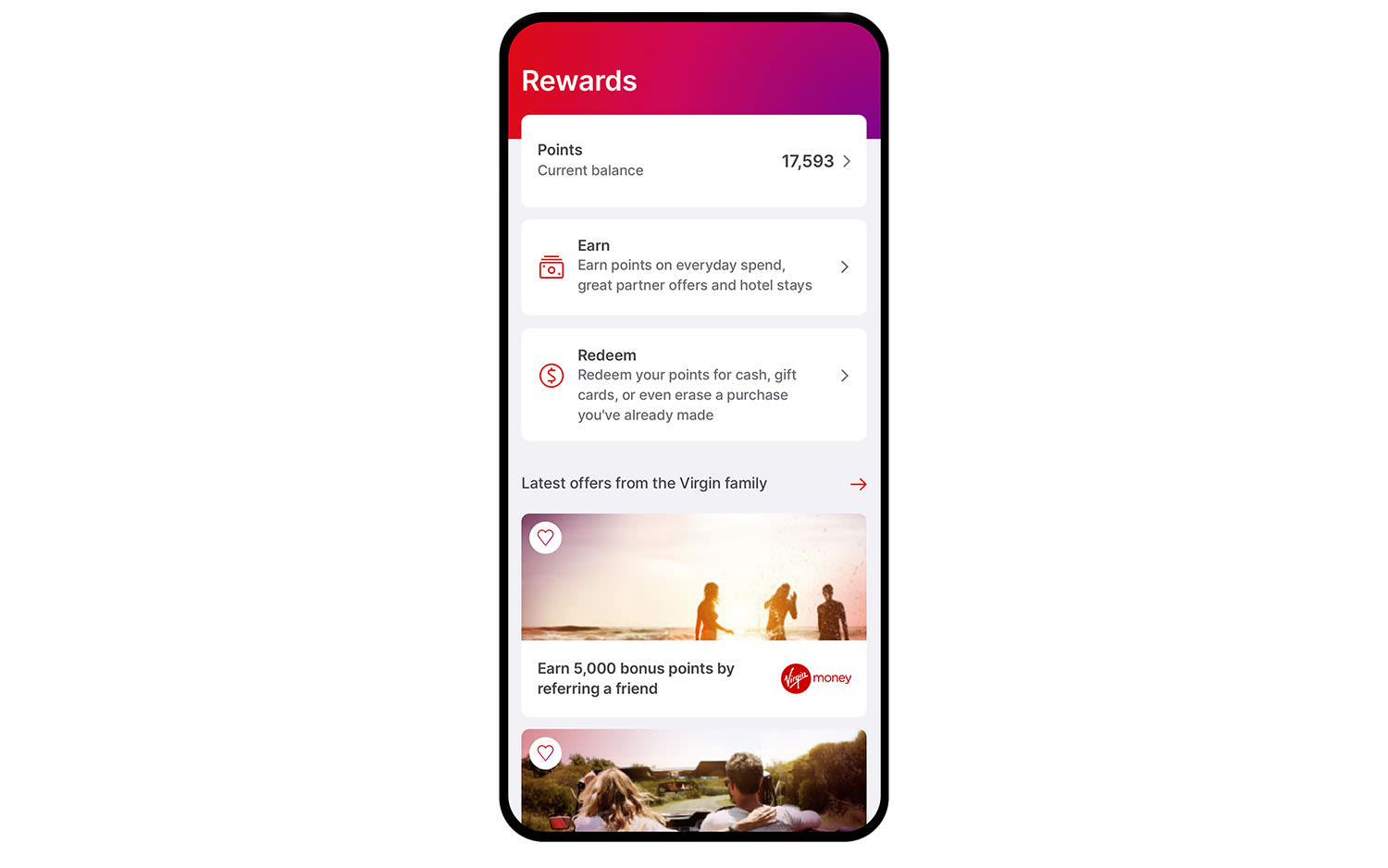

By banking with Virgin Money Australia you’ll be provided with a simple, seamless app which is focused on a straightforward user experience. With this app, all your finances can be at your fingertips, including credit cards, a high-interest current account and savings accounts. You’ll even be able to pay for purchases through your phone’s digital wallet while on the go at the touch of a button. Virgin Money Australia combines everything you could need with a promise of high interest rates, fantastic rewards and excellent customer service, so you don’t need to worry about shopping around.

And why are we doing all this? Because Virgin believes that banking should be effortless.

Rewarding loyalty

We’re fed up with seeing banks giving financial incentives to new customers for switching their accounts, while forgetting about their loyal customers by keeping interest rates low and giving poor quality customer service.

Virgin Money Australia offers customers fantastic sign-up incentives, as well as honouring loyalty with generous rewards and competitive interest rates.

The loyalty scheme means you can earn points easily on everyday purchases. These points build up quickly, and can be used to buy vouchers for hundreds of retailers. Retailers include Menulog, THE ICONIC and HelloFresh, and you can also enjoy a suite of Virgin family partners like Virgin Wines and Virgin Active.

If you’d rather keep your cash, you can turn points into cashback which will go directly into your account. All of this is easy to do. Your app will do the work for you and keep you updated with where you stand with your points.

Virgin Money Points is available with the Virgin Money Go transaction account, as well as Virgin Money Australia’s savings accounts – the Virgin Money Boost Saver account and the Virgin Money Grow Saver account.

Saving you money

Unlike most other rewards accounts, Virgin Money Australia’s digital banking customers won’t pay any monthly fees for any of the above accounts. That’s right – all your interest and rewards will go straight to your pocket without you having to pay a thing.

With the Virgin Money Go account you’ll be able to round up purchases to the nearest $1 and send across the spare cash straight to your savings account – allowing you to save your money for a rainy day. You’ll also be able to track your spending so you know exactly where your money is going each month. So if you’re not one for budgets, Virgin Money Australia’s digital banking app will do the hard work for you. You can even set yourself challenges and spend targets and the app will tell you how you’re getting on throughout the month.

Sound good? Head over to Virgin Money Australia to find out more.

For full terms and conditions go to https://virginmoney.com.au/bank-and-save/accounts#cta-open-account.